China

Introduction

China has the largest population in the world. Despite also having one of the largest land areas, China’s demand for premium wine relies heavily on wine imports. A burgeoning wine market in Asia, China’s wine imports account for approximately 40% and its per capita consumption is significantly lower than the world’s average signalling potential for future growth.

China has become the world’s fifth-largest wine consumer in account of wine becoming a status symbol by China’s growing middle class. The Chinese preference for red wine is apparent with 80% of wine consumed in China being red. The average price of imported wine has risen significantly year on year as a direct result of more Chinese consumers beginning to develop a mature and refined palate for fine wine. This is in part due to the numerous wine events organised by wine distributors and dinner parties hosted by wine ambassadors to inform and promote both old and new wines directly to the Chinese consumer while building strong relationships with Chinese partners. .

Geographic Location

Average Price of Import Wine

2017 – USD 3.70 per litre 2019 – USD 3.97 per litreAverage Wine Volume Per Capita

The total grape wine import volume decreased year by year, from 737.04 million litres in 2017 to 612.49 million litres in 2019, but the import value in 2018 was higher than that in 2017, and the average price of imported grape wine in 2019 was USD 3.97 per litre, higher than that of USD 3.70 per litre in 2017. It can be seen that Chinese consumers began to pay more attention to quality than quantity for grape wine Bar Graph: Top 10 Wine Producing Countries Leading Imports in 2021- France – import value US$1.058 billion

- Chile – import value US$269.7 million

- Italy – import value US$168.4 million

- Spain – import value US$162.1 million

- USA – import value US$75.5 million

- South Africa – import value US$32.9 million

- New Zealand – import value US$28.77 million

- Argentina – import value US$26.18 million

- Germany – import value US$25.8 million

Upcoming Wine Events

JamesSuckling Great Wines of the World Beijing

Tang Jiu Hui Chengdu

Vinexpo Shanghai

Wine To Asia Shenzhen

Prowein Shanghai

JamesSuckling Great wines of Italy

South Korea

Introduction

Located in East Asia, South Korea is a developed nation with a booming economy. Enjoying one of the fastest Internet connection speeds in the world, South Korea is also ranked as the world’s 10th largest economy by nominal GDP and 7th highest Asian country on the Human Development Index (HDI). South Koreans experience an affluent and modern city lifestyle with over 25 million people, almost half of the population living in Seoul, South Korea’s capital city and the 5th largest metropolitan area in the world.

South Koreans consume alcohol daily in both social and business settings. They consume more hard liquor than any other country, including Russia. While soju and beer remain the most convenient choice, the burgeoning wine scene in South Korea is a direct result of younger, more cosmopolitan South Koreans who travel extensively or study abroad and have experienced the established wine culture of the west.

Wine distributors with wine ambassadors play a significant role in promoting wine to restaurants because of the rich competition in terms of alcoholic beverages available in South Korea. South Koreans enjoy food and wine pairings and this explains the growth in consumption of white and sparkling wine in addition to red wines, the favourite for many Asian societies.

Geographic Location

Trade Agreements with South Korea

Upcoming Wine Events

Jamesuckling.com Great wines of The World

Jamesuckling.com Great wines of Italy

Japan

Introduction

An island country located in East Asia, Japan is the 11th most populous country in the world. Urbanised and economically developed, Japan is a member of numerous international organisations such as the United Nations (UN), Organisation for Economic Co-operation and Development (OECD) and the Group of Seven (G7).

The country with the largest number of sommeliers in the world, Japan embraces the European style of elevating the dining experience with a bottle of wine. By 2023, 68% of spending on wine will be attributed to wine consumed outside of the home. The Japanese tradition of Omakase, letting a chef choose your meal on your behalf extends to wine and restaurant sommeliers play a significant part in advising customers on which wines to pair with their meal. Complementing this is wine events and dinners organised by wine distributors with wine ambassadors mingling directly with wine consumers, sommeliers and Japanese media.

Japan is the 3rd largest economy in the world with a rich cultural history and an internationally recognised food and drinks culture. While sake, shochu and beer are popular options, wine is viewed as the healthier, more fashionable alcohol beverage choice and Japanese consumers are curious and keen to learn more about wine. This is especially evident from the reception of popular Japanese wine manga “Kami no Shizuku” or Drops of God.

Geographic Location

Trade Agreements with Japan

European Union

United Kingdom

Upcoming Wine Events

Supermarket Trade Show

Foodex Japan

Tre Bicchieri Gambero Rosso

Hong Kong

Introduction

Strategically located near the South China Sea, Hong Kong enjoys low taxation and free trade agreements making it the world’s 10th largest exporter and 9th largest importer. The densely populated city also ranks 4th on the UN Human Development Index (HDI) and has one of the highest life expectancies in the world. Home to one of the world’s most significant financial centres and commercial trading ports, Hong Kong has the largest concentration of ultra-high-net-worth individuals of any city in the world and has one of the highest per capita incomes globally.

While the Hong Kong wine market becomes increasingly saturated with many new players competing in a limited land area, it remains a valuable gateway for trading wine in China. Hong Kong is the ideal distribution hub as it is a duty-free port with state-of-the-art storage facilities and infrastructure. With the removal of all duty-related customs and administrative control in 2008, Hong Kong is the most cost-effective and convenient wine trading centres for the Asia Pacific market. Wine distributors and ambassadors congregate at Hong Kong wine events such as VinExpo and the Hong Kong International Wine and Spirits Fair.

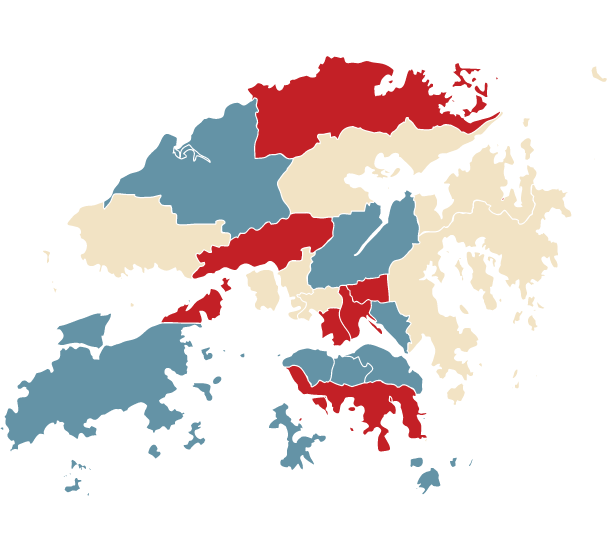

Geographic Location

Free Trade Agreements with Hong Kong

Following the removal of all duty-related customs and administrative controls in February 2008, Hong Kong has developed into a wine trading and distribution centre for the Asia Pacific region.

Upcoming Wine Events

VinExpo Hong Kong (May)

Taiwan

Introduction

Taiwan is a densely populated island nation located in East Asia. In the early 1960s, Taiwan experienced rapid economic growth that later became known as the Taiwan Miracle and is one of the 4 Asian Tigers alongside Singapore, South Korea and Hong Kong, known for exceptionally high growth rates and industrialisation success. Taiwan is a developed country with the 15th highest GDP per capita with a population of approximately 23.5 million. .

One of the top 5 wine markets in Asia, Taiwan’s wine market has evolved since the 1990s when wine was predominantly consumed by wealthy businessmen. Today, Taiwanese wine consumers are constantly seeking out different wines from both the old world and the new to pair with its vibrant food scene. One of the few Asian nations where wine almost equals beer in terms of preference, Taiwan’s wine consumption is increasing steadily and is expected to surpass 25 million litres in 2021.

Geographic Location

Upcoming Wine Events

Taipei Wine and Spirits

Festival

Wine and Gourmet

Tapei

Vietnam

Introduction

Vietnam is a developing country in Southeast Asia that is consistently ranked among the fastest-growing countries in the world. Strategically situated along the east edge of the Indochinese Peninsula, Vietnam continues to enjoy a high GDP growth rate due to its persistently strong economic growth in the last decade.

The 16th most populous country in the world, Vietnam is also experiencing a steady increase in disposable income with a Compounded Annual Growth Rate (CAGR) of 9.9%. In Vietnam, wine is seen as a status symbol and is still predominantly enjoyed at Hotels and Restaurants (70% of total wine) making it a key choice for old wine distributors. Wine ambassadors play a pivotal role in informing Vietnam’s wine taste because old wine is also used as a form of gift-giving and to impress in the business world. Vietnam’s wine consumption is set to grow by an average of 7.4%, one of the fastest in the region, corresponding with the increase in income.

Geographic Location

Trade Agreements with Vietnam

European Union

United Kingdom

Bar Graph:Wine Consumption

2021 – 0.2 litres per adult 2024 – 0.3 litres per adultUpcoming Wine Events

James Suckling Great Wine of the world

Cambodia

Introduction

Upcoming Wine Events

Malaysia

Introduction

Upcoming Wine Events

Laos

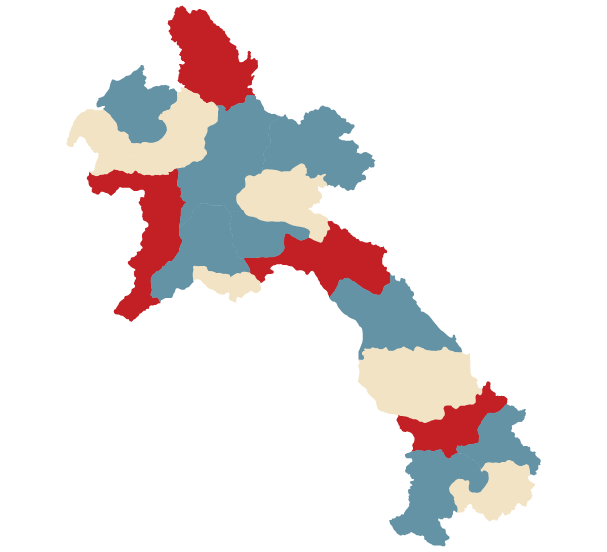

Introduction

Upcoming Wine Events

Singapore

Introduction

Prominently located in the heart of Southeast Asia, Singapore is a geographically small but thriving cosmopolitan city with the second-highest GDP per capita in terms of PPP (Purchasing Power Parity). Food is a national treasure here with numerous local delights highlighting the country’s vibrancy and multiculturalism.

Due to the limited land area, Singapore does not produce any wine and relies heavily on wine imports from countries such as Italy, Spain, Argentina, Chile, America and Australia. Singaporeans are increasingly choosing wine as their drink of choice. There is a steady increase in the number of Singaporeans enrolling in wine certification programs and masterclasses conducted by wine distributors and wine ambassadors to gain a deeper, more intimate understanding of the wine they enjoy.

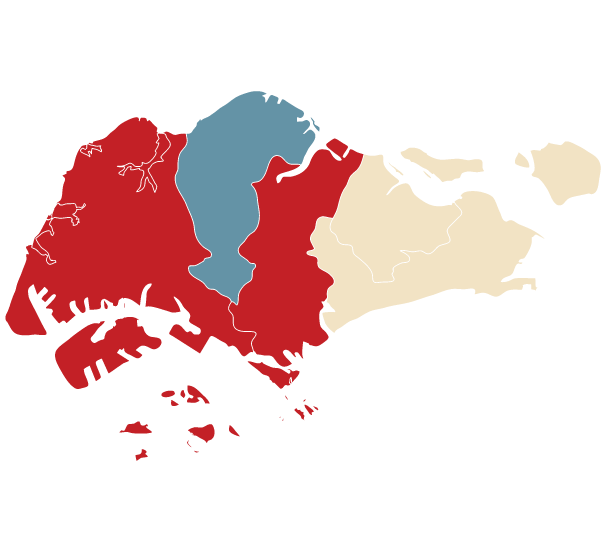

Geographic Location

Trade Agreements with Singapore

European Union

United Kingdom

Bar Graph:Wine Consumption

2019 – 2 ½ Bottles per capita 2021 – 4 bottles per capitaUpcoming Wine Events

ProWine Asia

The Great Wine & Dine Festival

Indonesia

Introduction

Upcoming Wine Events

Thailand

Introduction

Strategically located in the centre of the Indochinese Peninsula, The Kingdom of Thailand is a founding member of the Association of Southeast Asian Nations (ASEAN). In Southeast Asia, Thailand’s emerging economy is the second-largest and in terms of GDP per capita, this newly industrialised country is the 4th richest nation.

Thai cuisine is one of the most popular in the world. 7 Thai dishes were listed on the CNN travel poll for “World’s 50 Best Foods”, more than any other country. Thailand has an equally vibrant and lively drinks scene with over 2682 million litres of alcohol consumed annually. Currently 75% of alcohol consumption is beer while wine imports account for 15% with France, Australia and South Africa leading the list. Thai people are increasingly recognising premium wines through strategic and consistent promotion by wine exporters and wine ambassadors. The wine market in Thailand is set to grow and expand even further with new trade developments with wine-producing countries in the works.

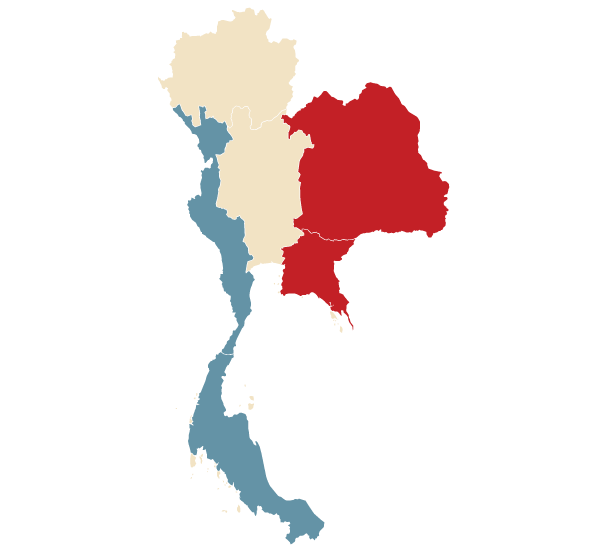

Geographic Location

Free Trade Agreements with Thailand

While Thailand does not currently have existing FTAs with the European Union (EU) and the United Kingdom (UK), The Bangkok Post has reported in 2020 both parties renewed interest in resuming talks to work towards signing an FTA.Market Size

Alcoholic drinks market: 2682 million litres Wine market size: 20.1 million litres Wine market of total alcohol consumption: 0.8%

Upcoming Wine Events

Philippines

Introduction